As you might’ve gathered from my post on Analyzing Investment Real Estate a couple months ago, I’m looking to buy an investment property. Well, lo and behold, I’ve had an offer accepted for my first property! That, however, is not the subject of this post. After talking with multiple lenders and having them all spitball me different numbers, I think I finally understand what goes into the cash due at closing (at least in Chicago). Get ready for another spreadsheet!

Download my Cash at Closing Spreadsheet

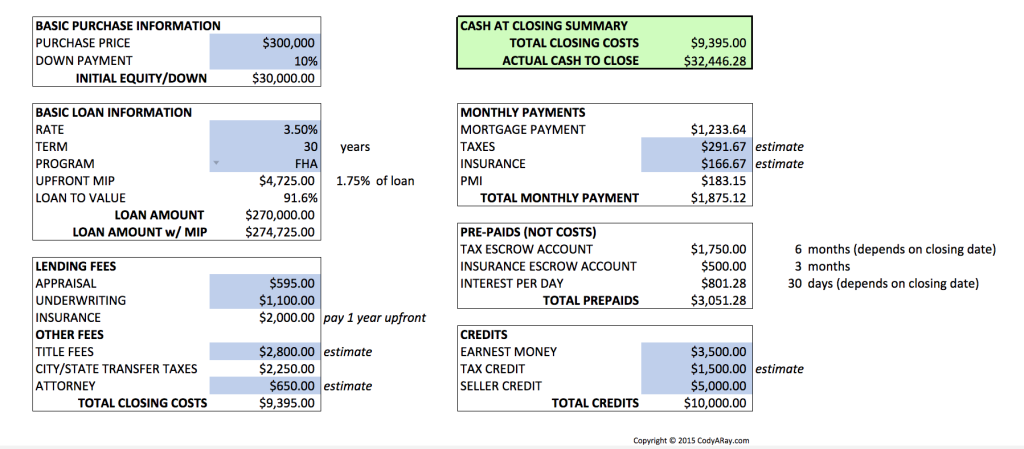

The cash due at closing is composed of five categories:

- Down Payment is the initial equity or ownership that you’ll have in the property. The amount of your downpayment determines the type of financing, the interest rates, and many other aspects of your purchase.

- Lending Fees include the underwriting fee, appraisal cost, and the first year of insurance. Lenders require insurance to protect their investment. Unlike property taxes which are paid in arrears, property taxes are paid in advance. As insurance is often paid annually, the first year of insurance is required. You must have arranged for homeowners insurance before the loan can be closed. When you sell the property, the annual payment will be prorated for the used months and the remaining payments should be refunded by the insurance company.

- Misc Fees include the title company fees, attorney fees, and any applicable city/state transfer taxes for transferring the title. The title company fees include insurance and recording charges. The title insurance protects against title defects, liens, or other matters. The recording charges are fees paid for updating the public record for the property. In addition the administrative recording charge, some counties impose a tax or surcharge fee on transferring the title of property.

- Prepaid Items include 3-to-6 months of property taxes in escrow, 3 months of insurance escrow, and interest from the closing date to the end of the month. These items are not expenses per se but rather future costs that are being paid up-front or stored in an escrow account until the payment is due sometime in the future. Taxes are paid in arrears (after-the-fact), so you simply pay a few months in advance to serve as a buffer in case you fall behind. This is sometimes true for insurance as well; even though you’ve paid for the current term of a year, another several months of costs may be requested to help cover the next payment in case you fall behind near the end of your term and are unable to catch-up before the next term begins.

- Credits include credits to the seller’s prorated taxes, any earnest money already paid, and any negotiated seller credits toward closing. The tax credit is to cover the seller’s portion of this year’s taxes since the expense has been occurred prior to closing but not yet paid. Although not technically a credit, any money you’ve paid into escrow as earnest money must be deducted from the remaining amount due at closing. Lastly, if you were able to negotiate any credit from the seller to help cover closing costs, this must be deducted from the amount due as well.

This spreadsheet works for both conventional and FHA loans, including calculations of up-front MIP and monthly PMI if applicable. The transfer tax rate is currently hardcoded to Chicago rates (0.75% of purchase price) and it assumes you’ll escrow 3-months of insurance in addition to paying for the first year upfront.

Download my Cash at Closing Spreadsheet

You’ll need to talk to several lenders to get estimate for each of these fees, rates, and expenses. The example shown is for a fictional three-unit purchased for $300k using a 10% down 30 year FHA loan. Although these aren’t my exact numbers, they’re at least ballpark for recent quotes in Chicago. For example, every Real Estate attorney with whom I’ve spoken has had flat rates in the $600-$700 range so far.

A few other useful tidbits I’ve learned:

- A conventional loan for a duplex requires 20% down even for owner-occupants.

- A conventional loan for a triplex (3-unit) or quadplex (4-unit) requires 25% down

- Owner-occupants can use FHA to put as little as 3.5% down for a 2-4 unit.

- If you put 5% or less with FHA, the percentage paid for PMI increases from 0.8% per year to 0.85% per year.

- Summary: my first investment will hopefully be a 3-unit owner-occupied property with 10% down 30-year fixed FHA.

Disclaimer: this is not a substitue for getting a Good Fath Estimate for one or more lenders prior to applying for a loan. I am not a lawyer, accountant, or your mom. Do your own homework.

If I’ve made any mistakes or you have any suggestions, let me know!

0 Responses

Stay in touch with the conversation, subscribe to the RSS feed for comments on this post.