Last week I had the free Personal Capital consultation. My “advisor” had run a portfolio analysis based on my aggregated information in the PC dashboard for me and wanted to share the results. I was a bit intrigued with their so-called “Tactical Weighting” portfolio allocation approach and wanted to discuss it here today.

Personal Portfolio Review

To set the stage for the need for Tactical Weighting, let’s discuss a few things that my advisor highlighted as a bit worrisome:

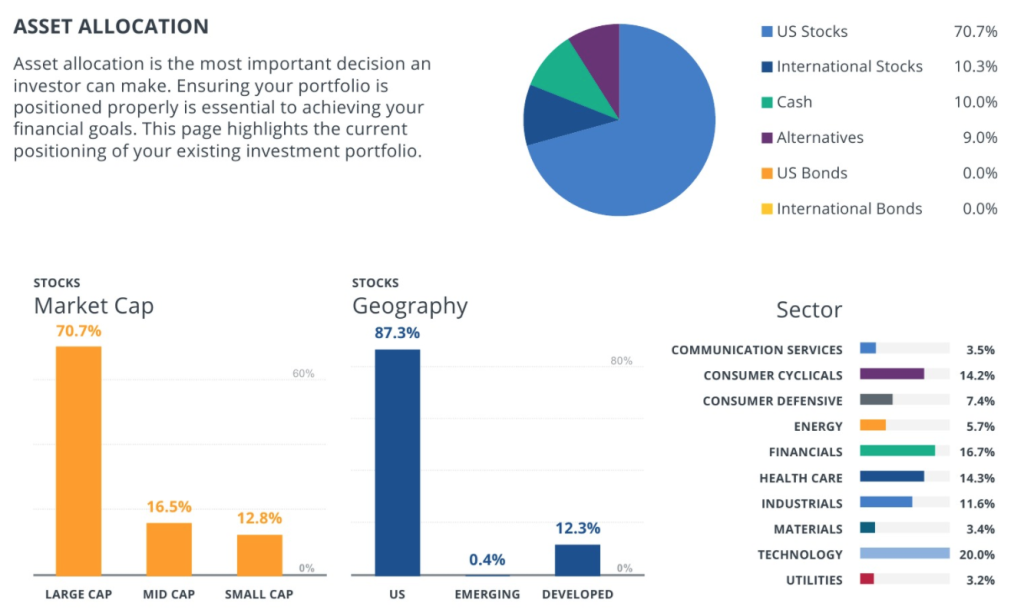

- cash holdings: I’m holding too much cash for my risk profile, both within investment accounts and in savings

- geographic concentration: I’m almost entirely invested in U.S. equities (besides cash and real estate holdings)

- sector concentration: I’m heavily weighted toward technology and financials

- market-cap concentration: I’m heavily weighted towards the largest of U.S. companies

Now I was aware that I’m holding a lot of cash, both because I’m saving for another real estate investment and because I want to keep some “dry powder” in my investment accounts for market corrections. (Admittedly, I need a more systematic game plan for handling a market correction.)

And at some level, I knew that I was very U.S.-focused. This doesn’t worry me much, as the largest U.S.-headquartered companies have significant international exposure. But I’ll probably rebalance some of my S&P500 index funds into international index funds to kill two birds with one stone (reduce both geographic and market-cap concentrations).

But the thing that has me worried most recently is how heavy my portfolio is on mega-sized growth stocks, particularly technology. I’ve come to dislike how much of my portfolio is allocated to the FANG stocks (Facebook, Apple, Netflix, Google) through large-cap index funds in various 401(k) and IRA accounts.

Sure enough, this was made readily apparent when reviewing my Sector allocation (above).

This is where Personal Capital’s “Tactical Weighting” approach comes in.

Tactical Weighting

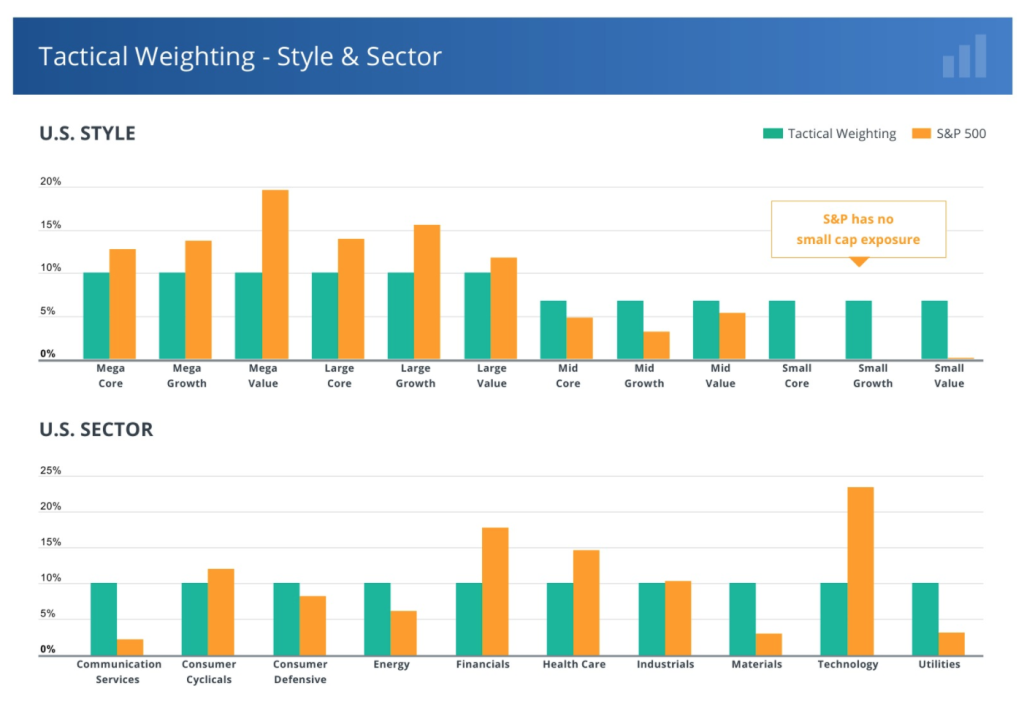

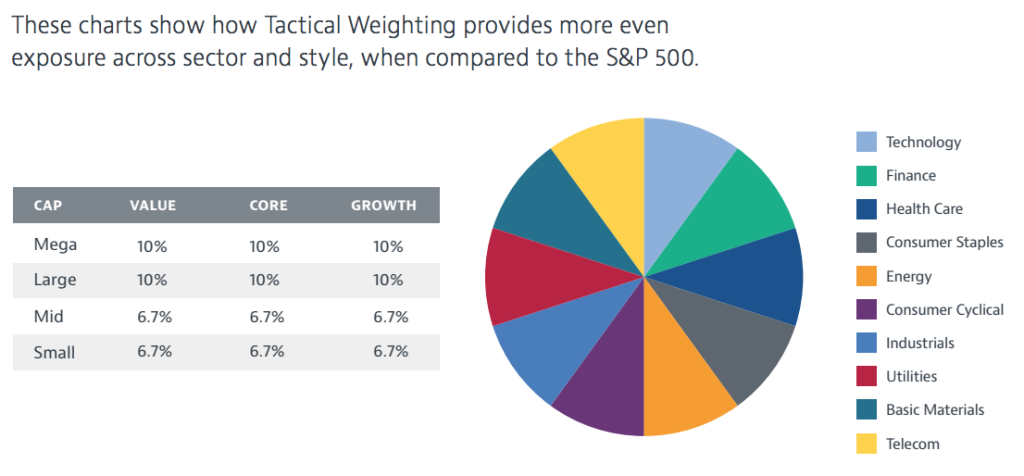

The summary of Personal Capital’s tactical weighting approach is that they do equal sector and style weighting. This means that your portfolio will have roughly 10% in each of the 10 sectors and be more equally spread across companies of various sizes and value/growth types.

As it was presented to me, this means your asset allocation within U.S. stocks would look more this:

So that’s kind of interesting. I’m not sure what the effect is for equal-weighting of sectors over a long period of time, other than you’re not investing in “the market”. You’re now trying to beat the market. Just a reminder:

Gross market returns minus investment fees equal the net returns actually delivered to investors. See http://www.vanguard.com/bogle_site/sp20060101.htm and http://www.stanford.edu/~wfsharpe/art/active/active.htm.

Although some people get lucky and choose a strategy that beats the larger market for some period of time, this means that someone else has to select another strategy that makes less than the market. More often than not, you’re paying excess fees to underperform everyone else. This is the entire basis for low-cost passive index fund investing.

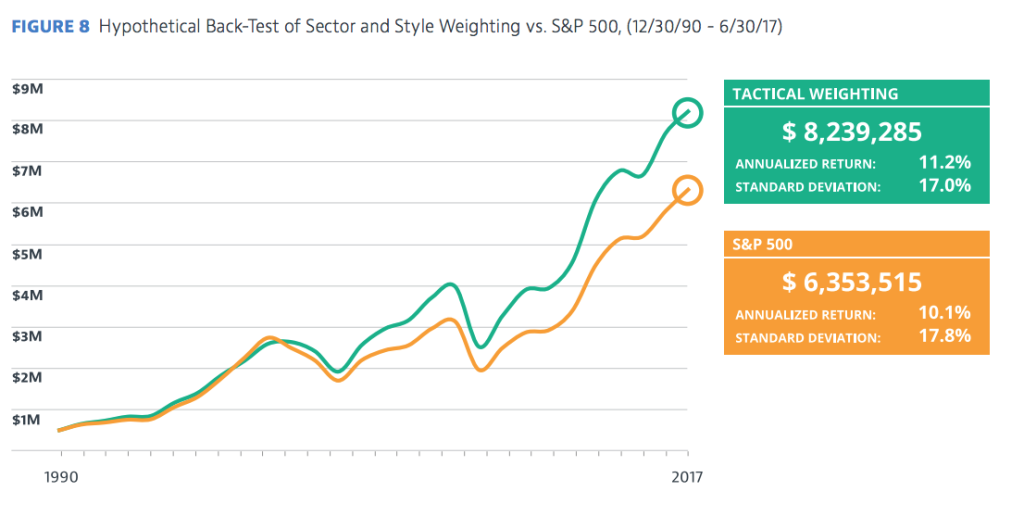

Next they compared the returns for their broadly diversified portfolio to the S&P500:

This is comparing apples and oranges since one contains small company stocks with traditionally more volatility and the other only contains the largest of the giant stocks.

Putting this aside, we see that Tactical Weighting outperformed by 1.1% per year. After deducting Personal Capital’s 0.89% annual fee, that’s only a 0.21% improvement. And that’s assuming there are no other “hidden fees” such as transaction costs or high bid-ask spreads for rebalancing, and that all expense ratios for the underlying funds in their portfolio can beat the extremely competitive Vanguard/Fidelity Spartan/Schwab Select index fund fees (0.03% to 0.07%) that I currently use.

It’s also interesting that the volatility (as measured by std dev here) was lower for the Tactical Portfolio than the S&P500. But mid-size companies outperformed their larger counterparts for a good portion of this time period. So I suspect that this lower volatility is an artifact of running the backtest over a time period in which this methodology worked unusually well. I’d love to see a backtest to 1900 to see if it holds up under other types of market conditions.

More broadly speaking, I want to know how the risk-adjusted returns compare. How do the Sharpe and/or Sortino ratios compare to the S&P500? I suspect any outperformance would be simply due to taking on more risk.

Fortunately, the advisor sent me this Investment Methodology with more details.

Now we’re getting a bit more specific. Let’s start by comparing the style weighting versus the Total Stock Market Index.

Here’s the “style box” for the Tactical Weighting portfolio, summarized from above:

| Target: | Tactical Weighting | |||

| 20 | 20 | 20 | large = | 60% |

| 6.7 | 6.7 | 6.7 | mid = | 20% |

| 6.7 | 6.7 | 6.7 | small = | 20% |

| value | balanced | growth | ||

| 33% | 33% | 33% | ||

Here’s the Total Stock Market breakdown, for reference:

| Reference: | Total Stock Market Index | |||

| 23 | 24 | 25 | large = | 72% |

| 6 | 6 | 6 | mid = | 18% |

| 3 | 3 | 3 | small = | 9% |

| value | balanced | growth | ||

| 32% | 33% | 34% | ||

Comparing Personal Capital’s Tactical Weighting style allocation to the Total Stock Market reveals that PC overweights mid-cap by 2% and small-cap by 11%, and overweights value stocks by 1%. There is ample evidence that small and value factor tilts improve performance.

With regards to equal weighting of sectors in Tactical Weighting, I really like the idea and it’s simplicity. It makes intuitive sense that it could shield you from a sector bubble (like the dotcom bust or the housing crash). It directly addresses my concerns with having so much of my portfolio in mega-growth tech stocks right now at all-time market highs.

Unfortunately, equal-weighting of sectors changes the nature of the portfolio. Instead of simply tracking the market, it would be attempting to outperform the market. And I haven’t seen sufficient data to have any such confidence. Besides, if I’m going to attempt to beat the market, it’s with classic Ben Graham style value investing in the small/micro-cap markets.

Conclusion

Personal Capital’s Tactical Weighting approach is very interesting at first glance. But after drilling into the details a bit, we can see that Tactical Weighting adds a lot of exposure to mid- and small- cap companies, as well as a bit more exposure to value-oriented investments. I’m unsure of the long-term effects of equal-sector weighting, but I believe the small/value tilts explain any relative outperformance of the market, both in their backtesting and real returns.

Like all small/value tilts, this likely comes at the cost of higher volatility and underperformance in certain market conditions. Better absolute performance, but roughly equal risk-adjusted performance. (I’d expect that comparing the sharpe/sortino ratios with VTSAX over a long enough time frame would reveal this.)

Personally, I’m unwilling to pay an additional 0.89% of my portfolio each year for this, on top of the underlying fund fees. I can tilt my portfolio toward small stocks by buying low-cost small cap index funds in addition to the S&P500 and Total Stock Market funds that I already hold.

- Schwab Small-Cap Index (SWSSX) at 0.05% expense ratio

- Fidelity Small-Cap Index (FSSVX) at 0.05%

- Vanguard Small-Cap Index (VSMAX) at 0.06%

If I want more mid-cap, then I’d look toward an “extended market” index that includes everything except the S&P500, such as the Fidelity Extended Market (FSEVX) at 0.07%.

For me, at least, I’ll be sticking with a low-cost passive approach using index funds, perhaps with a tilt toward small-cap stocks.

Thanks for writing this! I am currently looking into PC for personal advisory services and am intrigued, and skeptical, of how “Smart Weighting” will work over the next 20 years. I am also wondering how they go about selecting the various stocks to make up their “index.” In the end, they claim to beat the haystack by picking the 30 to 50 best “needles.” In the end, that still seem counter to what Mr. Bogle and even Buffet recommend. Curious to hear your thoughts on using someone like Vanguard. I am not sure what their rates are but they’d obviously recommend buying a diversified group of hay stacks and playing the log game.

I was also contacted by Personal Capital since i opened an aggregation account with them; They offered the same service, same analysis that they had for you. I am also skeptical of the performance based on their cost and you had few additional articles. Unless I am reading this chart incorrectly, seems like RSP (equal weighted) is outperforming.

also, if not personal capital, are you using someone else to help look through your investments (including real estate?). I have Vanguard Advisors who are good, but they are very much standard across everyone’s portfolio based on age and retirement age etc. They cost 0.003 which is cheap to manage funds.

https://www.google.com/search?tbm=fin&ei=PHIjXZuRFKXz5gKc5IvYCQ&stick=H4sIAAAAAAAAAONgecRozi3w8sc9YSm9SWtOXmPU4OIKzsgvd80rySypFJLiYoOyBKT4uHj00_UNC82MMgwqDA14AKdnATY8AAAA&q=NYSEARCA%3A+SPY&oq=SPY&gs_l=finance-immersive.1.0.81l3.2540.3204.0.6343.5.5.0.0.0.0.96.248.3.3.0..3..0…1.1.64.finance-immersive..2.3.248.0…0.J6RXN0-HZH4#scso=_Q3IjXZWUE4Kc5wK_jprIDw2:0&smids=/g/1ywbr0zyy&wptab=COMPARE

This answer won’t be very helpful, but I manage my portfolio myself. At this stage in my life, it’s not terribly difficult to manage myself… and I’m not willing to pay for anything like a standard “based on age and retirement” approach.

> you had few additional articles

What other articles would you be interested in? I love talking about this stuff. 🙂

Thanks for commenting!

Why not just save the Personal Capital fees and use the “Smart Weighting” with US Sector ETFs? I do this with a simple spreadsheet I built to match my asset allocations toward their recommendations without paying any fee.

You totally could do this if you had reason to believe that in an equal sector weighting approach. I glossed it over as an option because

> Instead of simply tracking the market, it would be attempting to outperform the market. And I haven’t seen sufficient data to have any such confidence.

For example, this would extremely overweight utilities, consumer staples, industrials and underweight IT and healthcare, relative to the weightings in the S&P500. Have you seen evidence that this approach will outperform over the long run? Any high-quality studies that have back tested this over various time periods?

Thanks for commenting!