My wife has started a women-focused coaching business, particularly around helping her clients improve their writing and communications. (Get in touch if you need help!) Many of her clients are entrepreneurs and the writing is particularly marketing-oriented. This has been fascinating and awesome to watch.

At the same time, she’s going through the entrepreneur journey herself, first by publishing her debut novel and now with the writing/coaching business. As she navigates the ups and the downs for herself and for her clients, I find myself trying to help by describing some of the trends, theory, and systems behind marketing and business growth.

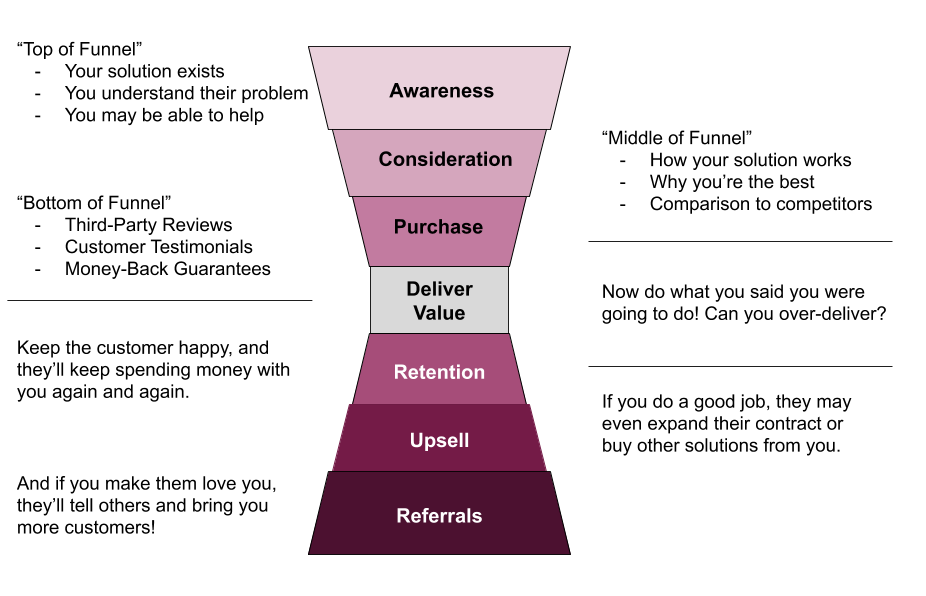

One of the first “lessons” we had was about the marketing and sales funnel. At the time, I drew it out by hand, but it looked a lot like this:

Almost all of her marketing so far has been through social media. She launched her writing/coaching business at a one-week “vendor fair” on Facebook, and had already built up quite an audience on Facebook and Instagram over the last several years just by investing in her relationships.

With these initial sales, the “buyers” are typically 1st or 2nd degree relationships already. That means that they’re already aware of her — and often of her roles and skills as a writer, teacher, cheerleader, and confidant — so they have a degree of trust. This means they start their “buying journey” in the consideration or even purchase level of the funnel. Awesome!

However, as she ventured into her second “vendor fair”, the audience wasn’t as close to her. These were primarily 3rd degree connections, and thus will take more effort (impressions, visibility, persuasion, etc) to close a sale. Compound that with the fact that there were fewer 1st and 2nd degree relations to cheer her on publicly and otherwise advocate/testify for her, and she doesn’t have as much “social proof” to help close the buying gap.

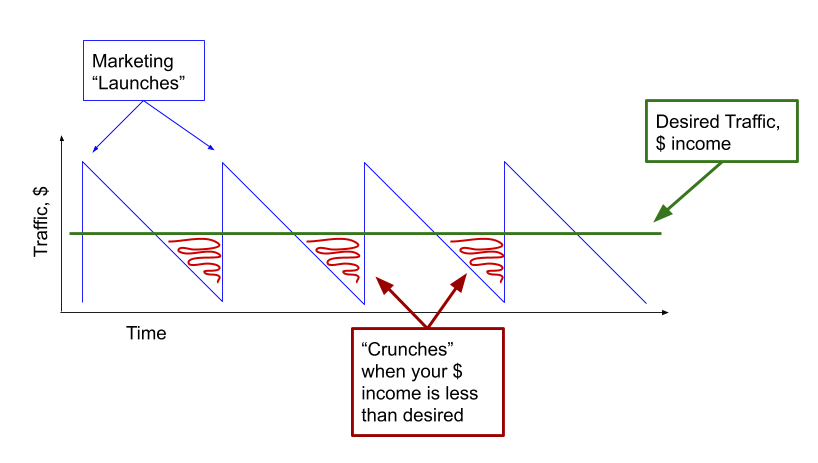

Fast forward to today and she was telling me about the slow-but-steady trickle of book reviews that are still coming in. She seemed a bit disheartened that they’ve slowed down from the early days, but I told her this is to be expected with any “launch” based business model (like book publishing) and that it needed continued marketing to continue sales.

We started talking about the relationship between marketing “launches” or “pushes” and the resulting traffic, income, reviews, etc that result further down the funnel. Flashing back to my electrical engineering days, I described this to her as a “sawtooth pattern” and compared it to her desired “steady-state” stable income:

This discussion led to something of an a-ha! moment (for me, at least :).

As a business owner, your goal is to find a way to transform the “marketing sawtooth” input into a stable “desired income” output.

Yes, this is a very engineering-oriented way of thinking about it. But business systems are just that… systems. More complex and nuanced than technical systems, yes, but fundamentally a business is still a system to transform some set of raw inputs (labor and/or assets) into desired outputs (a published book, happy clients, etc).

This is where the concept of the marketing funnel comes into play. By understanding this pipeline, including the conversion rates and lead time between each step in the funnel, you can ensure that you never end up in a “crunch”. In concrete terms, a crunch is when you don’t have enough business income to pay your bills or draw the income you (or your employees) need for living. This is shown as the red scribbled area under the green “desired income” line.

Tying it all back together, we were able to compare this to her piano business — she’s been teaching piano students for the last decade — and then to her writing business.

As a service business, and a part-time job, she can only have so many piano students at a time. So she has a waiting list of potential students. Sometimes, a student may be on that list a year or more before a “slot” opens up… usually due to a former student graduating high school, or sometimes just losing interest. Because she’s in demand, she can even fire advise the students who aren’t taking it seriously that it’s not a great use of their time/money, and immediately replace the lost income with a new student.

Likewise, the writing/coaching business is a part-time service business and she can only take on so many clients simultaneously. There are a few differences compared to her piano business, though:

- The per-hour income is higher for writing/coaching services (around 3x)

- However, the churn rate is also significantly higher (estimated around 6-14x). We don’t have enough data to quantify this yet, but I’m estimating a writing services customer lifetime of approximately 6 months compared to a typical 3-7 year customer lifetime as a piano student.

- With piano teaching, the competition is typically limited to the local area. Compare this to writing/coaching services which can be done from anywhere, and prospective clients often have urgent demands based on their business needs. Thus, waitlists are likely easier to implement to help “smooth the sawtooth” into a stable income for piano teaching than for writing/coaching services.

- This means that she’ll need to spend more time marketing her writing/coaching business, which eats into the time she has for servicing clients, and thus reduces her “billable hours” lower than if she had a waitlist.

Let’s do a bit of math. Plugging in realistic numbers, we can calculate the “customer lifetime value” (CLV) of a piano student vs a writing/coaching client.

- Piano student: $40 per an hour-long session, one session per week, for about 40 weeks per year. Let’s say that she retains the average piano student for 3.5 years. The CLV of the typical piano student is thus $40 * 40 * 3.5 = $5,600.

- Writing client: $200/mo for 4 hours per month. If the average writing client stays for 6 months, their CLV is $200 * 6 = $1,200. Note that this is the same number of hours per month as the piano student, and the rate is $10/hr more. But the total CLV is significantly less due to the difference in how long each client stays with her.

Does this mean that teaching piano is actually a better business? It depends.

To achieve the higher CLV also requires she dedicate significantly more hours over several years. Moreover, for my wife, she’s taught piano so long it no longer holds her interest like writing and coaching does. So there’s an aspect of personal fulfillment here.

Also, from a financial perspective, she’s early in her writing/coaching career and there’s a lot of optimizations and scaling techniques that she could use here, that likely wouldn’t work for piano teaching.

Using the same “framework” as above:

- As she continues extending her services beyond “piece by piece” writing services to more clients that have her on retainer (or monthly subscription), she likely improves her client retention.

- Potential CLV increase: if this increases retention to 18 months, the new CLV is $3,600.

- If she focuses less on writing and more on personal or life coaching, as she has been with several of her clients, that’s likely to result in a much more long-term engagement, potentially on the same order as piano teaching but with a higher per-hour income rate.

- Potential CLV increase: if this increases retention to 3.5 years (to match piano students), the new CLV is $8,4o0.

- If she builds a (commission-based) team, she can leverage her time to serve more clients. Then she’d be responsible for marketing, customer relationships, and quality assurance. Eventually, she could even hire team members to help with these activities as well, growing this into a standalone business that could potentially be sold one day.

- Potential CLV increase: if she does a 50/50 profit share with a writer/coach and retains a customer for 18-months, the new CLV is $1,800… but she’s unlocked scalability. She’s able to grow her business beyond the confines of the number of customers she can personally serve. Her new bottlenecks are around the number of customers she can find and the number/quality of people she can recruit.

- If she builds a writing or coaching community, she can leverage intra-client relationships to make her services even more “sticky”, increasing retention and at the same time increasing the likelihood of referrals from existing clients.

- Potential CLV increase: if this increases retention to 5 years and every 3rd customer refers in 1 additional new customer… well this business has potential. 🙂

These goals serve to ensure high client retention, which reduces marketing effort, which allows her to spend her time focusing on what she does best — helping clients. And this is better for her too, increasing the amount of “billable” hours she works which, when providing services which command a higher per-hour rate, increases her total stable income given the same number of working hours per week.

All that is to say, this is a very exciting time in the Ray household. 🙂

You are the best partner ever.